This year, discussing mobile game inevitably includes the topic of mini-games. Thanks to the outstanding performance of the mini-game "BangBang Survivor" (Chinese name: 向僵尸开炮), SP-Game has become a notable player in the game market.

Recently, SP-Game has taken new actions in the Hong Kong, Macau, and Taiwan regions. On July 11, they launched "見習狩獵家" which has achieved impressive market results, reaching as high as 3rd place on the Hong Kong iOS game sales ranking, and 4th in Taiwan and Macau.

Instead of adopting mainstream fantasy or the highly competitive wuxia themes, "見習狩獵家" opts for a unique primitive tribal theme.

To enhance its thematic appeal, "見習狩獵家" integrates pet-raising elements and introduces dragons, a fantasy creature with global influence, amplifying the game's thematic strengths.

Although the gameplay is conventional, the game optimizes numerical values and pacing for a more enjoyable early experience. For instance, players start at level 10 and can level up by 10 more levels within 10 minutes.

In addition to its theme and gameplay optimizations, the success of "見習狩獵家" in the market can also be attributed to effective marketing strategies.

01.SP-Game's Large-Scale Advertising Campaigns

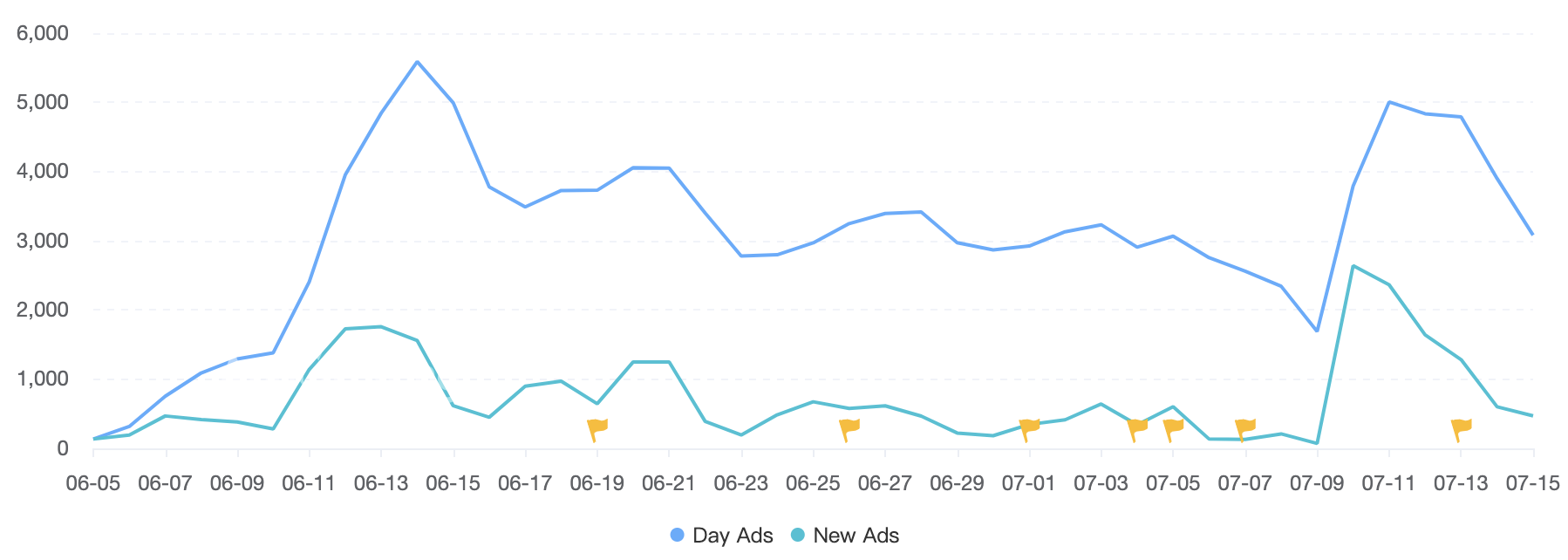

For "見習狩獵家," SP-Game continued its high-profile advertising strategy. According to AppGrowing , in the past month, "見習狩獵家" has launched close to 30,000 ads, surpassing "BangBang Survivor" as SP-Game's most advertised product.

Interestingly, while both "見習狩獵家" and "BangBang Survivor" employ high-profile advertising strategies, their execution differs significantly. After "BangBang Survivor" opened for pre-registration on April 25, SP-Game did not promote pre-registration ads.

In contrast, "見習狩獵家" followed a different approach. Starting June 5, SP-Game began advertising intensively, with daily ad volumes mostly exceeding 3,000, peaking at 5,589 ads, primarily targeting Taiwan and Hong Kong.

The different ad strategies for "BangBang Survivor" and "見習狩獵家" stem from their content volume differences. The company's CEO, Wang Shengyu, mentioned in an interview that allocating a large budget for pre-registration requires careful planning, setting realistic goals, and allocating the corresponding budget.

As a mini-game, "BangBang Survivor" needs to gain significant exposure in a short period after its launch."見習狩獵家" with its more substantial content, allowed SP-Game to explore more extensive marketing strategies.

Looking back, it's clear that the ad placements for "見習狩獵家" were not isolated actions. According to the official Facebook, at the same time the game began its ad campaign, the developers also announced collaborations with the movie "ULTRAMAN: The Rise," revealed their spokesperson (Wu Kang-ren), and launched pre-registration events.

According to Wang Shengyu, 90% of customer acquisition channels fundamentally come from ad purchases. Thus, they favor a high-profile advertising strategy.

However, they also place great emphasis on brand marketing, having accumulated substantial experience in this area from their earlier work in the MMO genre. They have a well-rounded understanding of community management and leveraging spokespersons.

On Facebook, their official account has amassed over 70,000 followers, and they frequently release various updates, from character and world-building introductions to event announcements and interactive lotteries. Like their ad strategy, they ensure high visibility and engagement within their user community through these frequent updates.

Subsequently, they also released a theme song sung by Lara Liang, a music video for the theme song, and a brand promo video featuring Wu Kang-ren. These elements fed back into the ad market, serving as promotional materials that boosted the game's advertising presence.

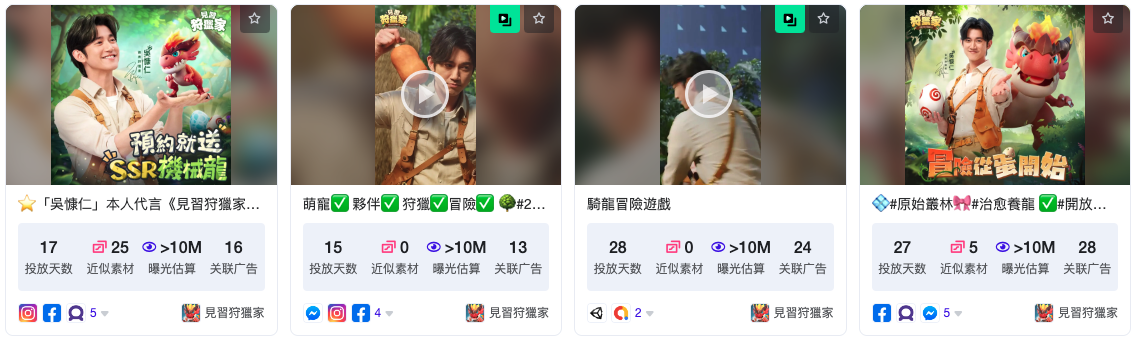

Specifically, the ad materials for "見習狩獵家" hat showcased gameplay elements like pet raising and evolution were well-received. Additionally, brand promo videos and the theme song MV featuring their spokesperson also garnered significant exposure.

Furthermore, in the community, the official account frequently posts various lottery interactions. In their ads, they also highlight substantial physical rewards. These ads feature actors with exaggerated performances repeatedly emphasizing their winnings, showcasing high-value prizes such as iPhones and MacBooks to attract players attention with the most direct and tempting rewards.

To cater to the preference for Real-Person videos among users in the Hong Kong, Macau, and Taiwan regions, the game employs skits to associate "見習狩獵家" with fame and status, portraying playing the game as a prestigious activity recognized by the elite and leading to success.

For instance, in one ad, a man faces divorce from his wife because he fails to capture a violent dinosaur in the game. The scene then shifts to a wealthy, handsome man leaning against a BMW, with a powerful mechanical dinosaur in the background, encouraging viewers to download the game to become stronger.

Clearly, whether in brand marketing or ad promotion, SP-Game adopts a high-profile strategy. However, the unique primitive tribe theme of "見習狩獵家" combined with the broad appeal of pet raising, supports this strategy.

According to Wang Shengyu, the premise for creating a card game is that the theme must attract a wide audience, targeting a broad user base. Only under these conditions can ad purchases and brand marketing truly be effective, leading to the success "見習狩獵家" has achieved today.

02.Seeking Greater Growth Opportunities

Earlier, SP-Game successfully established its brand in the Hong Kong and Macau regions through their accumulated experience in the MMO.

Back in 2021, SP-Game had a breakthrough year with the MMO "云之歌" which broke into the top ten of the iOS game sales ranking in Taiwan and Macau. With endorsements from Yihan Chen and and extensive advertising, the game achieved a revenue of 82 million yuan in its first month.

Following this success, the MMOs "永夜星神" and "圣钥" also performed well in Hong Kong and Macau. In 2023, they released "暮色双城" which remained in the top ten of the Taiwan iOS game sales ranking for nearly two months.

These consecutive successes helped SP-Game establish a strong foothold in Hong Kong and Macau. However, despite being high-value markets, their limited size prompted SP-Game to seek new market opportunities for growth.

In 2022, leveraging their accumulated MMO publishing experience in Hong Kong and Macau, SP-Game ventured into the Korean market. They released the MMOs "엑자일: 어벤징 파이어" and "이모탈 소울" both of which achieved notable success.

In 2023, they introduced an anime-styled MMO called "Land Arcana-ふしぎの大陸-" to Japan, which topped the iOS game free charts on its first day and ranked around 30th on the sales charts, marking a notable achievement.

Through a deep understanding and adjustment to the distribution market, SP-Game has established an efficient MMO distribution system in several markets.

However, another issue has gradually emerged. As a highly competitive and saturated genre, the MMO category has limited growth potential. Relying solely on MMOs for the company's future growth is not sustainable.

With rising promotional costs and a shrinking user base, the supply of Chinese MMO products has also significantly decreased. As a publisher, SP-Game is in a passive position regarding this change. Their primary strategy is to adapt to these evolving conditions.

In a media interview, Wang Shengyu mentioned that the Chinese gaming market is shifting towards lighter genres, and they must adapt. While maintaining a segment of heavy games, they need to develop the lighter segment. Consequently, they have turned their attention to the lighter card game genre, with mini-games naturally being a part of this strategy.

On SP-Game's official website, they describe their strategy as: "Focusing globally, deeply cultivating the Taiwan, Hong Kong, Macau, and South Korean markets, and continuously exploring the MMO, card, and idle game genres."

In the latest SensorTower ranking for mobile game revenue, "BangBang Survivor" reached 24th place. The recent success of "見習狩獵家" has further solidified their position in the card game genre. These achievements mark a significant step forward for SP-Game in their journey towards globalization and diversification.